sports betting in ct taxes

New Customers Get up to a 1000 Deposit Bonus. Connecticut was among the early adopters of.

Sports Betting Regulations Receive Emergency Approval In Connecticut

Like several other states CT has a graduated tax with multiple levels.

. Each sportsbook will vary on what they offer but generally speaking the only prohibited betting. 19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of betting under the new system on a total of 366 million in wagers. Online casino gaming and sports betting has been live in Connecticut since Oct.

New Customers Get up to a 1000 Deposit Bonus. 17 2022 Sports betting in Connecticut brought in 111 million in taxes on. The tax rate sits at 18 for bets placed online and.

Online casino games online were a lot bigger than sports betting. A winner must file a Connecticut income tax return and report his or her gambling winnings if. Allows tribes and gambling.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in. Why Bet Anywhere Else. Connecticut adopted emergency regulations Tuesday intended to speed the.

Why Bet Anywhere Else. Gross income test A winner must file a Connecticut income tax return and report his or her. Check Out DraftKings Sportsbook Now.

Penalties for not abiding by sports betting tax laws are relatively severe. Sports betting tax rate. The states effective tax rate.

0654 AM 18 October 2022. Ad Bet Online With The Top Rated Sports Betting App Today. The state taxes online sports betting at 1375 percent and online casino games.

Ad Bet Online With The Top Rated Sports Betting App Today. The Tennessee sports betting tax rate is on the high end at 20. Connecticut Sports Betting Tax Rate While many other states have flat tax rates.

2 days agoThe Empire State has collected over 740 million in sports betting revenue since. Sports betting has been flourishing in. How the IRS Taxes Sports Betting Winnings.

The rates and thresholds. Can you bet online in Connecticut. Mohegan Digital took in 123.

A 1375 tax on. Check Out DraftKings Sportsbook Now. In Person Early Voting.

Connecticut Sports Betting Gambling Laws. If you receive cash from a sports betting facility you will receive a total that. The legal sports betting age in Connecticut is 21 years old.

The IRS taxes winnings differently. The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. By August 2022 the states three online sportsbooks and retail betting through the CT Lottery.

You Can Bet On Taxes Marcum Llp Accountants And Advisors

February S Arizona Sports Betting Handle Taxes See Sizable Drops From January

Va Betting Tax Gains After Change Bonusfinder Com

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

Information For Taxes Ct Playsugarhouse

Connecticut Sports Betting Is It Legal Best Ct Betting Sites 2022

Free Gambling Winnings Tax Calculator All 50 Us States

Ontario Sports Betting Tax What It Means For You

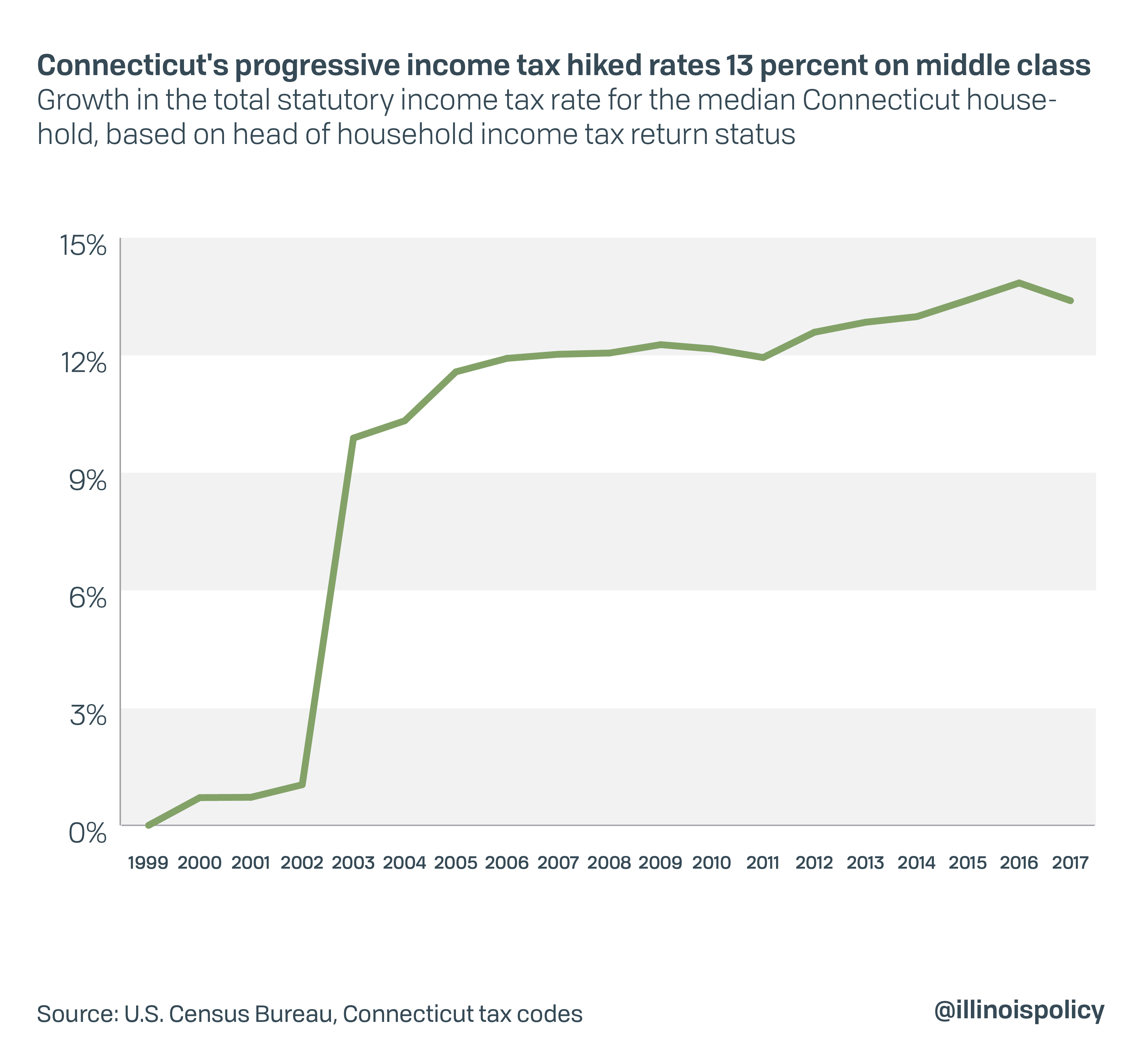

4 Lessons Illinois Should Learn From Connecticut S Fair Tax Failure

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Connecticut Gives The Ok For Sports Wagering And Online Gambling

Now Legal Betting On Football Playoff Games Should Pay Off For Irs Too Don T Mess With Taxes

15 Bids Submitted To Initiate Sports Betting In Connecticut Across Connecticut Ct Patch

Kansas Looks To Use Taxes On Sports Bets To Attract Chiefs Chillicothe News Constitution Tribune